Those keen to accelerate their business plans should explore the world's most exciting city

For regular updates on the latest London developments in terms of tech, investment, innovation and more, sign up to London Calling, our weekly roundup of London's hot topics.

LONDON

REMAINS AN INTERNATIONAL POWERHOUSE

REMAINS AN INTERNATIONAL POWERHOUSE

No other city can adapt to change quite as quickly as London

In his prime the poet William Wordsworth stood on Westminster Bridge and marvelled at this city. "Earth has not any thing to show more fair," he wrote. "Ships, towers, domes, theatres, and temples lie, open to the fields and to the sky".

Two hundred years later the dazzling vision he gazed upon is brighter than ever. London is Europe's richest city. The home of banking. The tech centre. And London's position as number one means it attracts elite talent from across the globe. Progressively, the more London outclasses rivals, the stronger it becomes.

A glance at the skyline tells the story. Almost a hundred brand new skyscrapers puncture the horizon, up three-fold on the previous year. Londoners love to give these buildings catchy names: The Gherkin, The Cheesegrater, and The Walkie Talkie. Soon The Trellis will rise to become Europe's second tallest building behind its neighbour, The Shard. Below ground, the new Crossrail 2 underground trainline is Europe's biggest ever infrastructure project.

Two hundred years later the dazzling vision he gazed upon is brighter than ever. London is Europe's richest city. The home of banking. The tech centre. And London's position as number one means it attracts elite talent from across the globe. Progressively, the more London outclasses rivals, the stronger it becomes.

A glance at the skyline tells the story. Almost a hundred brand new skyscrapers puncture the horizon, up three-fold on the previous year. Londoners love to give these buildings catchy names: The Gherkin, The Cheesegrater, and The Walkie Talkie. Soon The Trellis will rise to become Europe's second tallest building behind its neighbour, The Shard. Below ground, the new Crossrail 2 underground trainline is Europe's biggest ever infrastructure project.

Companies in London scale faster than anywhere in Europe. A good guide is the list of unicorns the city can boast. There are more unicorns in London than France, Germany and Italy put together. There are incubators, accelerators, and co-working spaces to help start-ups climb the first rung of the ladder. As companies grow, VCs and private equity investors are ready to inject capital to propel them skyward. London is the fourth most invested city in the world for tech – as of 2019 – and companies in London thrive with the network and support levels that this accolade brings with it.

This report is a guide to why beyond 2020, you should explore the world's most exciting city. The more companies base themselves here, the more London becomes the epicentre of world trade. Those keen to accelerate their business plans can experience the raw energy of London for themselves. No other city can adapt to change quite as quickly as London.

This report is a guide to why beyond 2020, you should explore the world's most exciting city. The more companies base themselves here, the more London becomes the epicentre of world trade. Those keen to accelerate their business plans can experience the raw energy of London for themselves. No other city can adapt to change quite as quickly as London.

LONDON SUPPORTS SUCCESS

Whatever stage of the business journey your organisation is embarking on, you can be best positioned to succeed in London

"Where else in Europe can I hire three hundred world class software engineers? Copenhagen? Rome? Dublin? Are you kidding? For a company like ours the only place we can achieve our ambitions is London." The speaker is Paul Taylor, founder of banking software start-up Thought Machine. Just a year ago the company had a few dozen employees. By the end of 2020 it was targeting 450. "In London we have global banks on our doorstep. Our clients are here. Our investors are here. We are in the eye of the storm."

This is a view you'll hear a lot in London. Here are the reasons why the city is the best place in Europe for start-ups:

From idea to first sale

Got an idea for a company? The city is dotted with more than 200 accelerators and incubators to nurture fragile concepts into reality. There is CyLon, for cyber security. For engineers there is the Enterprise Hub at the Royal Academy of Engineering, offering grant funding. And of course, the Barclays Accelerator which offers entrepreneurs unprecedented support in the world of finance and fintech. Schemes are constantly launching.

Attractive tax breaks

"London is a really good place to raise money," says Alexia Panagopoulou, Head of Finance at Lenses.io, a platform for simplifying organisational data flows. "The Enterprise Investment Scheme (EIS) and the Seed Enterprise Investment Scheme (SEIS) are examples of the attractive tax breaks available to certain companies when looking to find investment. The tax advantaged share plans, like the Enterprise Management Incentive scheme, can then be used to attract and retain good employees". The EIS and the SEIS are two of four venture capital schemes that aim to boost investment in UK start-ups, going from total investment of £150,000 under SEIS to £12m under the EIS.

This is a view you'll hear a lot in London. Here are the reasons why the city is the best place in Europe for start-ups:

From idea to first sale

Got an idea for a company? The city is dotted with more than 200 accelerators and incubators to nurture fragile concepts into reality. There is CyLon, for cyber security. For engineers there is the Enterprise Hub at the Royal Academy of Engineering, offering grant funding. And of course, the Barclays Accelerator which offers entrepreneurs unprecedented support in the world of finance and fintech. Schemes are constantly launching.

Attractive tax breaks

"London is a really good place to raise money," says Alexia Panagopoulou, Head of Finance at Lenses.io, a platform for simplifying organisational data flows. "The Enterprise Investment Scheme (EIS) and the Seed Enterprise Investment Scheme (SEIS) are examples of the attractive tax breaks available to certain companies when looking to find investment. The tax advantaged share plans, like the Enterprise Management Incentive scheme, can then be used to attract and retain good employees". The EIS and the SEIS are two of four venture capital schemes that aim to boost investment in UK start-ups, going from total investment of £150,000 under SEIS to £12m under the EIS.

Enthusiastic investors

Great ideas need sympathetic investors. Here London excels. The city is teeming with early-stage investors. There are at least 17 angel networks where start-ups can find investment. Gerard Grech, chief executive of Tech Nation said of the London investment scene, "In 2019 the UK secured a formidable 33% of all European tech investment despite accounting for roughly 9% of Europe's population".

Spinouts from academia

Great ideas used to stay locked up in research labs. Not anymore. The UK is a pioneer at commercialising great ideas. London universities are known for their friendly reception of potential partners who want to work with academics – just get directly in touch. For example, near King's Cross is the London Centre for Nanotechnology, a research centre for manipulating matter at the atomic level. Companies such as Google, Microsoft and Hitachi regularly visit to investigate breakthroughs in quantum computing and microchip technologies. Other interested parties are invited to make contact for a tour or introductions.

Unrivalled talent pool

Matt Miesnieks, ex-chief executive of 6D.ai, an augmented reality cloud start-up acquired by Naintic in March 2020, needs world class talent. He said he's grateful his company in London was "able to recruit world class engineers outside the craziness of Silicon Valley". Talent is available for companies of all sizes, "The opportunity is to be able to tap into a talent pool that only large companies would normally have access to." In terms of tech talent, there's no comparison, London is home to 251,000 developers, the largest community in Europe. The range of languages is broader than anywhere else and diversity and inclusion across age, gender, race, and disabilities, are world leading.

Great ideas need sympathetic investors. Here London excels. The city is teeming with early-stage investors. There are at least 17 angel networks where start-ups can find investment. Gerard Grech, chief executive of Tech Nation said of the London investment scene, "In 2019 the UK secured a formidable 33% of all European tech investment despite accounting for roughly 9% of Europe's population".

Spinouts from academia

Great ideas used to stay locked up in research labs. Not anymore. The UK is a pioneer at commercialising great ideas. London universities are known for their friendly reception of potential partners who want to work with academics – just get directly in touch. For example, near King's Cross is the London Centre for Nanotechnology, a research centre for manipulating matter at the atomic level. Companies such as Google, Microsoft and Hitachi regularly visit to investigate breakthroughs in quantum computing and microchip technologies. Other interested parties are invited to make contact for a tour or introductions.

Unrivalled talent pool

Matt Miesnieks, ex-chief executive of 6D.ai, an augmented reality cloud start-up acquired by Naintic in March 2020, needs world class talent. He said he's grateful his company in London was "able to recruit world class engineers outside the craziness of Silicon Valley". Talent is available for companies of all sizes, "The opportunity is to be able to tap into a talent pool that only large companies would normally have access to." In terms of tech talent, there's no comparison, London is home to 251,000 developers, the largest community in Europe. The range of languages is broader than anywhere else and diversity and inclusion across age, gender, race, and disabilities, are world leading.

"THE CITY IS DOTTED WITH MORE THAN 200 ACCELERATORS AND INCUBATORS TO NURTURE FRAGILE CONCEPTS INTO REALITY"

| FINTECH ECOSYSTEM PACKS A PUNCH London's fintech scene continues to flourish, as the city's innovative culture helps starts-ups and incumbents succeed |

Fintech is London's trump card. It's where the financial might of the City collides with the tech skills of the universities and private sector. The result is the world's leading venue for fintech.

One of the best known is Starling Bank. Anne Boden, a financial services veteran, recognised the potential for the technology sector to transform how people manage their finances, in a way where traditional banks were failing.

In 2014, Starling Bank was formed and armed with a small team around her, Boden's journey of building a new app-only bank commenced. Whilst one recognisable member of that early team – Tom Blomfield – ultimately left and went on to create his own competing challenger bank, Monzo, the early years in their London office paved the way for Starling's future success. Today it has raised £363 million and a string of high-profile TV adverts and successful London Underground campaigns means it proudly boasts 1.9 million loyal customers.

It is one of the few UK challenger banks that was aiming towards profitability as early as Christmas 2020 and promotes diversity at work, with 40% of all senior roles filled by women.

And how has London contributed to their success? It's by having an enviable ecosystem that allows the finance and tech sectors to work in harmony together, side by side. Boden has benefited from that and says, "In London, you have them both coming together and a vibrant community here, as well as a very supportive regulator." Nowhere is this more true than London.

Across the city, every financial activity is being disrupted by fintechs. Insurance, wealth management, personal investing, lending, payments... it's all up for grabs and all being changed by London-based firms.

In 2014, Starling Bank was formed and armed with a small team around her, Boden's journey of building a new app-only bank commenced. Whilst one recognisable member of that early team – Tom Blomfield – ultimately left and went on to create his own competing challenger bank, Monzo, the early years in their London office paved the way for Starling's future success. Today it has raised £363 million and a string of high-profile TV adverts and successful London Underground campaigns means it proudly boasts 1.9 million loyal customers.

It is one of the few UK challenger banks that was aiming towards profitability as early as Christmas 2020 and promotes diversity at work, with 40% of all senior roles filled by women.

And how has London contributed to their success? It's by having an enviable ecosystem that allows the finance and tech sectors to work in harmony together, side by side. Boden has benefited from that and says, "In London, you have them both coming together and a vibrant community here, as well as a very supportive regulator." Nowhere is this more true than London.

Across the city, every financial activity is being disrupted by fintechs. Insurance, wealth management, personal investing, lending, payments... it's all up for grabs and all being changed by London-based firms.

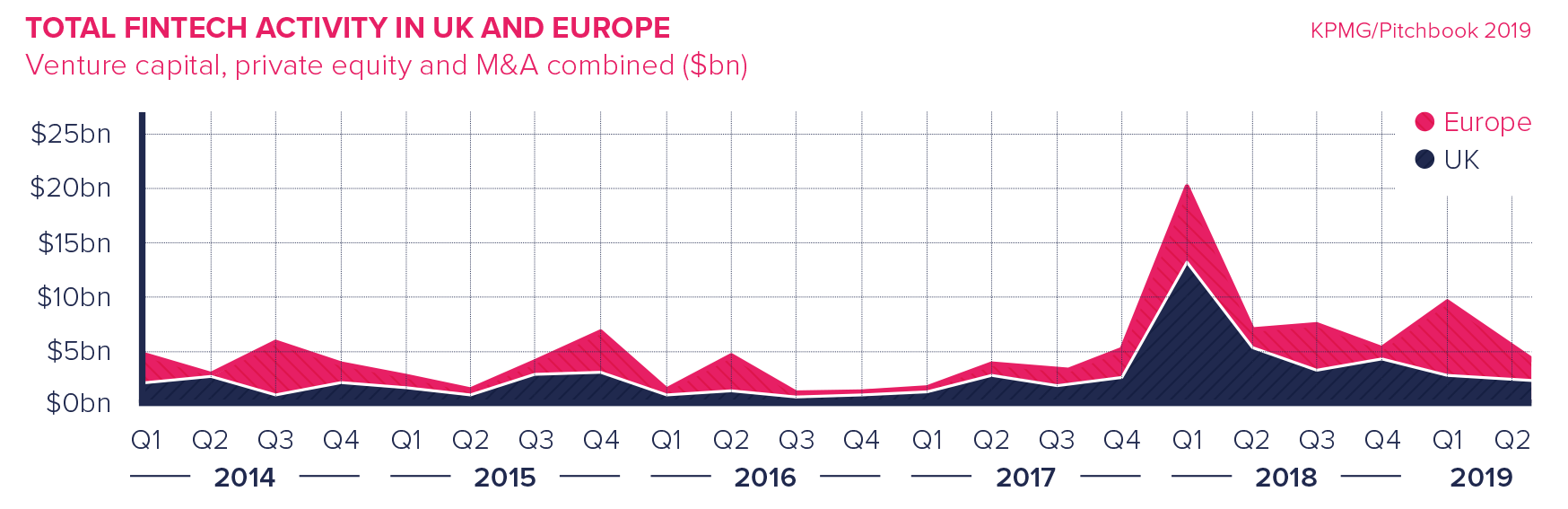

In fact, between 2014 and 2018 London's fintech sector received more than five times the investment of any other European city. That's more venture capital than Paris, Frankfurt, Berlin and Amsterdam combined.

A key reason is the regulator's ability to both invigilate, and foster innovation. The Financial Conduct Authority runs a sandbox – an experimental environment to test new ideas. To date more than 700 companies have been helped, accelerating time to market by 40 per cent. For example, London headquartered bitcoin firm Luno (which was acquired in September 2020 by Digital Currency Group) used the FCA's sandbox to evaluate ideas with regulatory supervision and advice. It means disruptive firms can explore the limits of the law, without developing concepts that are going to be vetoed further down the line.

The winner, of course, is the consumer. Andrew Bailey, the former Chief Executive of the FCA, said at the recent annual public meeting; "Innovation offers huge opportunities for consumer good – our Sandbox is testament to that". Londoners are reaping the rewards by having access to next-generation financial services. The average person on the street is starting to see some the impact of advancements on their ability to manage their banking, including payments and investments which might be held by different providers, from a single app.

According to a survey of more than 2,000 people at the height of the coronavirus pandemic, 66% of people were regularly using financial technology between March and July 2020 – this is an increase of over 50% compared to 2019's usage figures. Naturally, the rest of the world will one day enjoy the same benefits. But right now, it's Londoners who get to enjoy the products they helped to develop.

A key reason is the regulator's ability to both invigilate, and foster innovation. The Financial Conduct Authority runs a sandbox – an experimental environment to test new ideas. To date more than 700 companies have been helped, accelerating time to market by 40 per cent. For example, London headquartered bitcoin firm Luno (which was acquired in September 2020 by Digital Currency Group) used the FCA's sandbox to evaluate ideas with regulatory supervision and advice. It means disruptive firms can explore the limits of the law, without developing concepts that are going to be vetoed further down the line.

The winner, of course, is the consumer. Andrew Bailey, the former Chief Executive of the FCA, said at the recent annual public meeting; "Innovation offers huge opportunities for consumer good – our Sandbox is testament to that". Londoners are reaping the rewards by having access to next-generation financial services. The average person on the street is starting to see some the impact of advancements on their ability to manage their banking, including payments and investments which might be held by different providers, from a single app.

According to a survey of more than 2,000 people at the height of the coronavirus pandemic, 66% of people were regularly using financial technology between March and July 2020 – this is an increase of over 50% compared to 2019's usage figures. Naturally, the rest of the world will one day enjoy the same benefits. But right now, it's Londoners who get to enjoy the products they helped to develop.

"AN ENVIABLE ECOSYSTEM THAT ALLOWS THE FINANCE AND TECH SECTORS TO WORK IN HARMONY TOGETHER, SIDE BY SIDE"

| OPEN BANKING DRIVING FINANCIAL INNOVATION Open Banking has been in force for almost three years and is catalysing major changes in UK finance and fintech |

A new force is blasting through the European financial system. Open Banking is forcing traditional banks to share customer data (with permission) with third-party service providers. Open Banking is changing the landscape of finance, and London is at the forefront.

For example, Freedom Finance is a search engine for loans. Jake Ranson, Freedom Finance's chief customer officer, says the new data laws underpin its service. "It allows us to collate the most comprehensive view of a borrower and present back to them a better and broader range of personalised offers than they could have got from their credit data alone," says Ranson.

Open Banking is making the UK attractive to American companies. Plaid, a San Francisco fintech company focussed on financial infrastructure, has opened a London office to serve its European expansion. Zach Perret, co-founder and chief executive of the company, has previously described the impact open banking has had on banks and fintechs as a "sea change".

Plaid's software helps to connect more than 15,000 US banks. Now European fintech companies can use Plaid's service to connect to UK bank accounts. Emma, a money management app, is one of the early adopters of Plaid's system. Perret has previously indicated that the opportunity is immense for Plaid: "For fintech in the UK, there's this incredible boom… It's a market we've always wanted to be in."

It's still early days for Open Banking, and the opportunities are still being explored. Account aggregation is possible: so customers can see all their bank accounts, across providers, from a single log-in. And there are some imaginative uses.

For example, Freedom Finance is a search engine for loans. Jake Ranson, Freedom Finance's chief customer officer, says the new data laws underpin its service. "It allows us to collate the most comprehensive view of a borrower and present back to them a better and broader range of personalised offers than they could have got from their credit data alone," says Ranson.

Open Banking is making the UK attractive to American companies. Plaid, a San Francisco fintech company focussed on financial infrastructure, has opened a London office to serve its European expansion. Zach Perret, co-founder and chief executive of the company, has previously described the impact open banking has had on banks and fintechs as a "sea change".

Plaid's software helps to connect more than 15,000 US banks. Now European fintech companies can use Plaid's service to connect to UK bank accounts. Emma, a money management app, is one of the early adopters of Plaid's system. Perret has previously indicated that the opportunity is immense for Plaid: "For fintech in the UK, there's this incredible boom… It's a market we've always wanted to be in."

It's still early days for Open Banking, and the opportunities are still being explored. Account aggregation is possible: so customers can see all their bank accounts, across providers, from a single log-in. And there are some imaginative uses.

CreditLadder uses Open Banking to report rent payments to credit reference agencies, thus improving the credit score of the user. Habito, a mortgage broker and search service, has launched an API to allow its partners to integrate its offering within their own service. The old model of finance companies competing for consumers is ending. This is a collaborative model – where coalitions of companies come together to offer a group of services.

Will the disruption continue? Monzo bank's head of Open Banking, Kieran McHugh, said: "I think in general people tend to overestimate the potential of new technologies in the short term, and underestimate the potential of new technologies in the long term."

One exciting avenue is the ability for start-ups to access the data of high street banks via an API. This means instant access to millions of customers for start-ups. It's why there's so much hype around the concept.

Anyone entering the UK financial markets is without a doubt going to hear a lot about Open Banking. The impact of the revolution is yet to be felt, but make no mistake, there are profound implications on the horizon. In the US, large tech companies are already established to reap the benefits of open banking.

Google has become the latest firm to move into banking by offering smart current accounts. Ultimately, it is this proximity, the laws, language and unique time zone that truly set London apart as the fintech capital of the world.

Will the disruption continue? Monzo bank's head of Open Banking, Kieran McHugh, said: "I think in general people tend to overestimate the potential of new technologies in the short term, and underestimate the potential of new technologies in the long term."

One exciting avenue is the ability for start-ups to access the data of high street banks via an API. This means instant access to millions of customers for start-ups. It's why there's so much hype around the concept.

Anyone entering the UK financial markets is without a doubt going to hear a lot about Open Banking. The impact of the revolution is yet to be felt, but make no mistake, there are profound implications on the horizon. In the US, large tech companies are already established to reap the benefits of open banking.

Google has become the latest firm to move into banking by offering smart current accounts. Ultimately, it is this proximity, the laws, language and unique time zone that truly set London apart as the fintech capital of the world.

LONDON TECH SCENE CONTINUES TO THRIVE

7,000 employees can be housed at the Google Campus in King's Cross

200 Researchers in the new integrated Centre for AI hosted by UCL

LinkedIn moved into it's new UK HQ in Farringdon in January 2019

3,527 UK tech groups in London looking to connect and collaborate

357,900 London tops the ranking for the total number of software developers in Europe ahead of Paris, which has 268,600

£13.5m The cost of the Cyber Innovation Centre launched in 2018

£10m Research centre opening for medical advancements in AI at Imperial College London

The UK government offers a number of financial incentives for businesses, such as rate reliefs, the Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme

64,000 London has the world's highest concentration of financial and professional services firms

1,400 Staff to be employed by Apple in their new London HQ scheduled to open in Battersea

| RETHINKING RISK How London regtech firms are leading the way in reshaping the global risk and regulatory landscape |

Conundrum: the financial rulebook in the UK runs to 638,000 words. As the governor of the Bank of England put it, this is "longer than War and Peace. It is also somewhat less interesting and infinitely more complex."

How can any company comply with such a rulebook? The answer? Regtech. This emerging field uses the might of artificial intelligence and machine learning to help finance organisations comply with the law. Naturally, London is the world centre. A third of the REGTECH100 ranking of the hottest firms in the sector are from the UK.

Its big business, with spending estimated to reach £115 billion by 2023. But this could be money well spent. Banks have paid more than £300 billion in fines since 2008, and the average global bank until recently employed 7,000 compliance officers, up four-fold since the financial crisis.

Home to pioneers

Quantexa is a great example of a regtech pioneer. It uses AI to detect financial crime. Its algorithms search through piles of data (too large for any human to sift through) to discover anomalies to combat anti-money laundering, credit risk, and errant consumer behaviour. Quantexa's thinking is cutting-edge, and London is the ideal home. Not only does Quantexa have a client base on its doorstep, it is able to raise funds too. After three rounds, Quantexa raised a total of £17.9m, a sign of the faith investors have in both the team and the sector.

ClauseMatch is another London rising star. It puts all compliance documents into a single portal. An AI assistant alerts users for the impact of new policy announcements, identifies policy gaps, and spots compliance failures. ClauseMatch has won clients from across the fintech and banking world. And it's also supported by London's start-up scene. It joined an accelerator programme run by Lloyds of London, the venerable insurer. ClauseMatch made use of free co-working space, mentoring by legal experts, and access to funding.

How can any company comply with such a rulebook? The answer? Regtech. This emerging field uses the might of artificial intelligence and machine learning to help finance organisations comply with the law. Naturally, London is the world centre. A third of the REGTECH100 ranking of the hottest firms in the sector are from the UK.

Its big business, with spending estimated to reach £115 billion by 2023. But this could be money well spent. Banks have paid more than £300 billion in fines since 2008, and the average global bank until recently employed 7,000 compliance officers, up four-fold since the financial crisis.

Home to pioneers

Quantexa is a great example of a regtech pioneer. It uses AI to detect financial crime. Its algorithms search through piles of data (too large for any human to sift through) to discover anomalies to combat anti-money laundering, credit risk, and errant consumer behaviour. Quantexa's thinking is cutting-edge, and London is the ideal home. Not only does Quantexa have a client base on its doorstep, it is able to raise funds too. After three rounds, Quantexa raised a total of £17.9m, a sign of the faith investors have in both the team and the sector.

ClauseMatch is another London rising star. It puts all compliance documents into a single portal. An AI assistant alerts users for the impact of new policy announcements, identifies policy gaps, and spots compliance failures. ClauseMatch has won clients from across the fintech and banking world. And it's also supported by London's start-up scene. It joined an accelerator programme run by Lloyds of London, the venerable insurer. ClauseMatch made use of free co-working space, mentoring by legal experts, and access to funding.

Insuretech

Alongside regtech is insuretech – the use of technology to improve the insurance industry. Again, AI and machine learning are at the heart of it. Alex Dalyac is a pioneer in the field. He graduated from Imperial College with a PhD in machine learning, and two years later set up Tractable, an AI image recognition company – now on its way to unicorn status. His company uses intelligent image recognition to speed up damage assessment for insurers. An AI engine can look at a photo of a damaged car and instantly provide a rough quote for the repairs. That quote can then be compared to quotes from mechanics, to guarantee the insurer isn't overpaying. It's a remarkably flexible technology – leading to Tractable raising £26.4m from investors.

Cyber

The third pillar in the quest for stability is cyber. The war against hackers and thieves never ends, and recently London has pulled ahead of rivals to become the world centre of cyber security.

There are more than 800 cyber security companies in the UK, with more than half in the capital. There are global brands here: Onfido, which verifies identities from photos; Digital Shadows, an anti-data loss service; email security provider Tessian; application security software firm SentryBay; and Darktrace.

Darktrace, above all, captures the entrepreneurial spirit of the sector. Founded in 2013 by Poppy Gustafsson, who now runs the company as co-CEO with Nicole Egan, Darktrace uses AI to detect cyber intrusions or compromised computer security. The pair are breathtakingly ambitious, opening 40 offices worldwide, and winning 500 clients in Asia-Pacific. The company is targeting a valuation of $5 billion dollars.

Doing business in London means working alongside global leaders in regtech, insuretech, and cyber security. The size of the London financial markets means there is a natural symbiosis. The clients are here. So, it's where entrepreneurs need to be. London will be the dominant force in these three key sectors for the foreseeable future.

Alongside regtech is insuretech – the use of technology to improve the insurance industry. Again, AI and machine learning are at the heart of it. Alex Dalyac is a pioneer in the field. He graduated from Imperial College with a PhD in machine learning, and two years later set up Tractable, an AI image recognition company – now on its way to unicorn status. His company uses intelligent image recognition to speed up damage assessment for insurers. An AI engine can look at a photo of a damaged car and instantly provide a rough quote for the repairs. That quote can then be compared to quotes from mechanics, to guarantee the insurer isn't overpaying. It's a remarkably flexible technology – leading to Tractable raising £26.4m from investors.

Cyber

The third pillar in the quest for stability is cyber. The war against hackers and thieves never ends, and recently London has pulled ahead of rivals to become the world centre of cyber security.

There are more than 800 cyber security companies in the UK, with more than half in the capital. There are global brands here: Onfido, which verifies identities from photos; Digital Shadows, an anti-data loss service; email security provider Tessian; application security software firm SentryBay; and Darktrace.

Darktrace, above all, captures the entrepreneurial spirit of the sector. Founded in 2013 by Poppy Gustafsson, who now runs the company as co-CEO with Nicole Egan, Darktrace uses AI to detect cyber intrusions or compromised computer security. The pair are breathtakingly ambitious, opening 40 offices worldwide, and winning 500 clients in Asia-Pacific. The company is targeting a valuation of $5 billion dollars.

Doing business in London means working alongside global leaders in regtech, insuretech, and cyber security. The size of the London financial markets means there is a natural symbiosis. The clients are here. So, it's where entrepreneurs need to be. London will be the dominant force in these three key sectors for the foreseeable future.

"DOING BUSINESS IN LONDON MEANS WORKING ALONGSIDE GLOBAL LEADERS IN REGTECH, INSURETECH, AND CYBER SECURITY"

| THE WORLD'S CAPITAL CITY It's not hard to see why organisations are choosing to set up a holding company in London for their international operations. The city provides practical reasons to call it home |

Organisations with a growing presence outside of North America are experiencing the complications that come from having to operate in multiple different countries. Consolidating that presence in London is easier than it would be anywhere else.

There are many practical reasons that a company might decide to locate a holding company in the UK's capital. Aside from the low corporate tax rate and the ability to exempt dividends from taxable income, a London based holding company will benefit from over 130 tax treaties with other countries, reducing the impact of withholding taxes and other barriers to cross-border trade.

As well as a pragmatic attitude to taxation, the UK has a depth and substance that means international businesses can adapt to the changing global market, customer demands and new laws with relative ease. It is simply possible to Do More. Achieve More. And with better people than anywhere else.

London was Fastly's first expansion outside of North America, and Smith, one of the first two recruits, has seen their UK presence grow. "We need the best-in-class in all areas," says Smith. "Technical skills, language skills, and creative skills are all important. Further, our customers are innovators leading their respective industries, and they move rapidly so Fastly needs people who can move at the right pace while keeping quality of work, customer support, and engineering innovation up to our standards."

There are many practical reasons that a company might decide to locate a holding company in the UK's capital. Aside from the low corporate tax rate and the ability to exempt dividends from taxable income, a London based holding company will benefit from over 130 tax treaties with other countries, reducing the impact of withholding taxes and other barriers to cross-border trade.

As well as a pragmatic attitude to taxation, the UK has a depth and substance that means international businesses can adapt to the changing global market, customer demands and new laws with relative ease. It is simply possible to Do More. Achieve More. And with better people than anywhere else.

London was Fastly's first expansion outside of North America, and Smith, one of the first two recruits, has seen their UK presence grow. "We need the best-in-class in all areas," says Smith. "Technical skills, language skills, and creative skills are all important. Further, our customers are innovators leading their respective industries, and they move rapidly so Fastly needs people who can move at the right pace while keeping quality of work, customer support, and engineering innovation up to our standards."

Further, our customers are innovators leading their respective industries, and they move rapidly so Fastly needs people who can move at the right pace while keeping quality of work, customer support, and engineering innovation up to our standards."

Inside the M25 (the motorway that encircles the capital city), employers have access to a workforce that comes from all over the world, creating a melting pot of experiences and stories that brings a uniquely global quality to a London office. Once you have found the right recruit, the UK rules mean that a fair balance is struck between the rights of the employee and employer. That is not always true of other European cities and allows for businesses to pivot or make changes in most situations.

It is a fact of international expansion that plans can change, and a business based in London will enjoy opportunities and flexibility to keep ahead of the competition.

Similarly, as well as bridging the time zones between the US and Asia Pacific, London also benefits from the shared language and cultural commonalities with the US. All this combined, makes managing this new skilled workforce easier.

The holding company ecosystem in London has developed over many years and permeates the whole city. For anyone consolidating outside of their home country, London is the obvious choice.

Inside the M25 (the motorway that encircles the capital city), employers have access to a workforce that comes from all over the world, creating a melting pot of experiences and stories that brings a uniquely global quality to a London office. Once you have found the right recruit, the UK rules mean that a fair balance is struck between the rights of the employee and employer. That is not always true of other European cities and allows for businesses to pivot or make changes in most situations.

It is a fact of international expansion that plans can change, and a business based in London will enjoy opportunities and flexibility to keep ahead of the competition.

Similarly, as well as bridging the time zones between the US and Asia Pacific, London also benefits from the shared language and cultural commonalities with the US. All this combined, makes managing this new skilled workforce easier.

The holding company ecosystem in London has developed over many years and permeates the whole city. For anyone consolidating outside of their home country, London is the obvious choice.

1

WHAT INFOMATION IS NEEDED TO REGISTER A UK COMPANY IN THE UK?

Registered address

Company name

2

3

4

Details of at least one director and shareholder

5

Memorandum and articles of association

Share capital

| VALUE OF CREATIVE CAPITAL Despite its excellence in fintech, London's rich cultural diversity means it is equally a leader in the creative industries |

It's hardly unusual for a city to be bustling with creative spirits.

The boulevards of Paris are teeming with portrait artists, and Dublin pubs throng with poets. London? It's the place where creativity pays.

VFX

Today the big earner is visual effects for the movie industry. Framestore is the biggest name in the city. Founded in 1986, the company hit the jackpot with the Harry Potter films, starting with the Philosopher's Stone. It created Dobby the House Elf and Buckbeak the Hippogriff and did the job so well Warner Brothers relied on the studio for all the films in the series. Today Framestore employs 2,400 staff and has won 14 Emmys, and an Academy Award for best visual effects in The Golden Compass. Rivals include Milk VFX, used by Netflix for its 4k resolution series, and DNEG, involved in four of the ten films shortlisted for best picture at the 2019 Academy Awards. A stroll through Soho takes you past dozens of other studios, from 3D specialists and CGI, to animation and storyboarding.

Adland

Advertising is huge in London, with players like Bombora and Amobee making waves in the city. In 2018 the capital won more Cannes Lions (Europe's top awards for advertising) than any other European country.

The boulevards of Paris are teeming with portrait artists, and Dublin pubs throng with poets. London? It's the place where creativity pays.

VFX

Today the big earner is visual effects for the movie industry. Framestore is the biggest name in the city. Founded in 1986, the company hit the jackpot with the Harry Potter films, starting with the Philosopher's Stone. It created Dobby the House Elf and Buckbeak the Hippogriff and did the job so well Warner Brothers relied on the studio for all the films in the series. Today Framestore employs 2,400 staff and has won 14 Emmys, and an Academy Award for best visual effects in The Golden Compass. Rivals include Milk VFX, used by Netflix for its 4k resolution series, and DNEG, involved in four of the ten films shortlisted for best picture at the 2019 Academy Awards. A stroll through Soho takes you past dozens of other studios, from 3D specialists and CGI, to animation and storyboarding.

Adland

Advertising is huge in London, with players like Bombora and Amobee making waves in the city. In 2018 the capital won more Cannes Lions (Europe's top awards for advertising) than any other European country.

The UK was the first country to spend more on digital than traditional ad media.Around 140,000 work in advertising in the London. The new frontier is digital advertising. The UK was the first country to spend more on digital than traditional ad media. Adtech is growing. This is the use of technology to promote products. For example, programmatic advertising uses an automated online bidding system to auction space on websites in a millisecond. Bidders calculate the value of the user, their inventory, and dozens of other factors to place the right bid for each slot. The concept was conceived and perfected by London companies.

PlayStations and PCs

Computer games is another booming industry. There are 634 computer games companies in the capital, such as Curve Digital led by the man responsible for Lara Croft Tomb Raider, and 22 Cans whose games regularly feature in the Apple App Store's top games of the year. Behind the success is the conveyor belt of talent coming out of universities. London has six focussed on gaming, plus the Digital Schoolhouse, a specialist programme for children supported by Nintendo, PlayStation, and Sega. Top talent starts young in London.

PlayStations and PCs

Computer games is another booming industry. There are 634 computer games companies in the capital, such as Curve Digital led by the man responsible for Lara Croft Tomb Raider, and 22 Cans whose games regularly feature in the Apple App Store's top games of the year. Behind the success is the conveyor belt of talent coming out of universities. London has six focussed on gaming, plus the Digital Schoolhouse, a specialist programme for children supported by Nintendo, PlayStation, and Sega. Top talent starts young in London.

" IN LONDON, INNOVATORS LIKE THESE ARE YOUR NEIGHBOURS"

| LONDON: HEART OF INNOVATION So what can London offer the rest of the world? Can newcomers really arrive and thrive? |

The success of London depends on attracting young, diverse and hungry talent. This is where the most talented individuals migrate to build their careers on the biggest stage of all. North Americans too. When Facebook, Google, and Snap wanted a European base, they chose the same district in King's Cross.

They'll soon have a new neighbour, the machine learning giant DeepMind moving to the area in a new purpose built HQ. The company developed a self-learning chess engine, which beat the nearest rival after only 4 hours of seeing its first chess board. The dream is to build a general AI, capable of handling any tasks. Where else would DeepMind want to be?

In London, innovators like these are your neighbours. Twenty minutes from Europe's tallest building just south of the river to Sherlock Holmes' residence on Baker Street takes the traveller via the financial capital of the world by Bank tube, the hedge fund centre in Mayfair, the fashion world of Carnaby Street, and the greatest music and cultural venues of any city on earth.

They'll soon have a new neighbour, the machine learning giant DeepMind moving to the area in a new purpose built HQ. The company developed a self-learning chess engine, which beat the nearest rival after only 4 hours of seeing its first chess board. The dream is to build a general AI, capable of handling any tasks. Where else would DeepMind want to be?

In London, innovators like these are your neighbours. Twenty minutes from Europe's tallest building just south of the river to Sherlock Holmes' residence on Baker Street takes the traveller via the financial capital of the world by Bank tube, the hedge fund centre in Mayfair, the fashion world of Carnaby Street, and the greatest music and cultural venues of any city on earth.

Naturally, you'll need a partner who knows the capital. ZEDRA London has been working with world class companies, from start-up to multinational for over 28 years. Their team of experts can help you get the most from London, to conquer Europe and beyond.

"London is more than a city," says Jamie Richardson of ZEDRA London. "Its role for the future is to be a stage for ambitious minds from across the world to find each other and work together. We're proud to help newcomers to the capital make it their home. We are passionate advocates for living and working in London. Whether you're looking for architecture or art, food or fashion, London's 2,000 year history has shaped it into the resilient, colourful city you see today. Post-pandemic, you can come and discover for yourself that there's nowhere on earth quite like London."

"London is more than a city," says Jamie Richardson of ZEDRA London. "Its role for the future is to be a stage for ambitious minds from across the world to find each other and work together. We're proud to help newcomers to the capital make it their home. We are passionate advocates for living and working in London. Whether you're looking for architecture or art, food or fashion, London's 2,000 year history has shaped it into the resilient, colourful city you see today. Post-pandemic, you can come and discover for yourself that there's nowhere on earth quite like London."